FINANCING & COST

The Affordable Cost of LASIK Eye Surgery and Vision Correction with Financing, Discounts, and Healthcare Benefits

If you’ve started comparing the cost of different LASIK, cataract, and vision correction surgery providers, it’s important to consider the doctors’ experience, approach, and reputation along with price. At Durrie Vision, we’re committed to making safe, high-quality vision correction as financially accessible as possible, so you never have to compromise on your care or results.

"It’s been 24 hours since my surgery and it’s already the best investment and worth every penny."

– Emilee

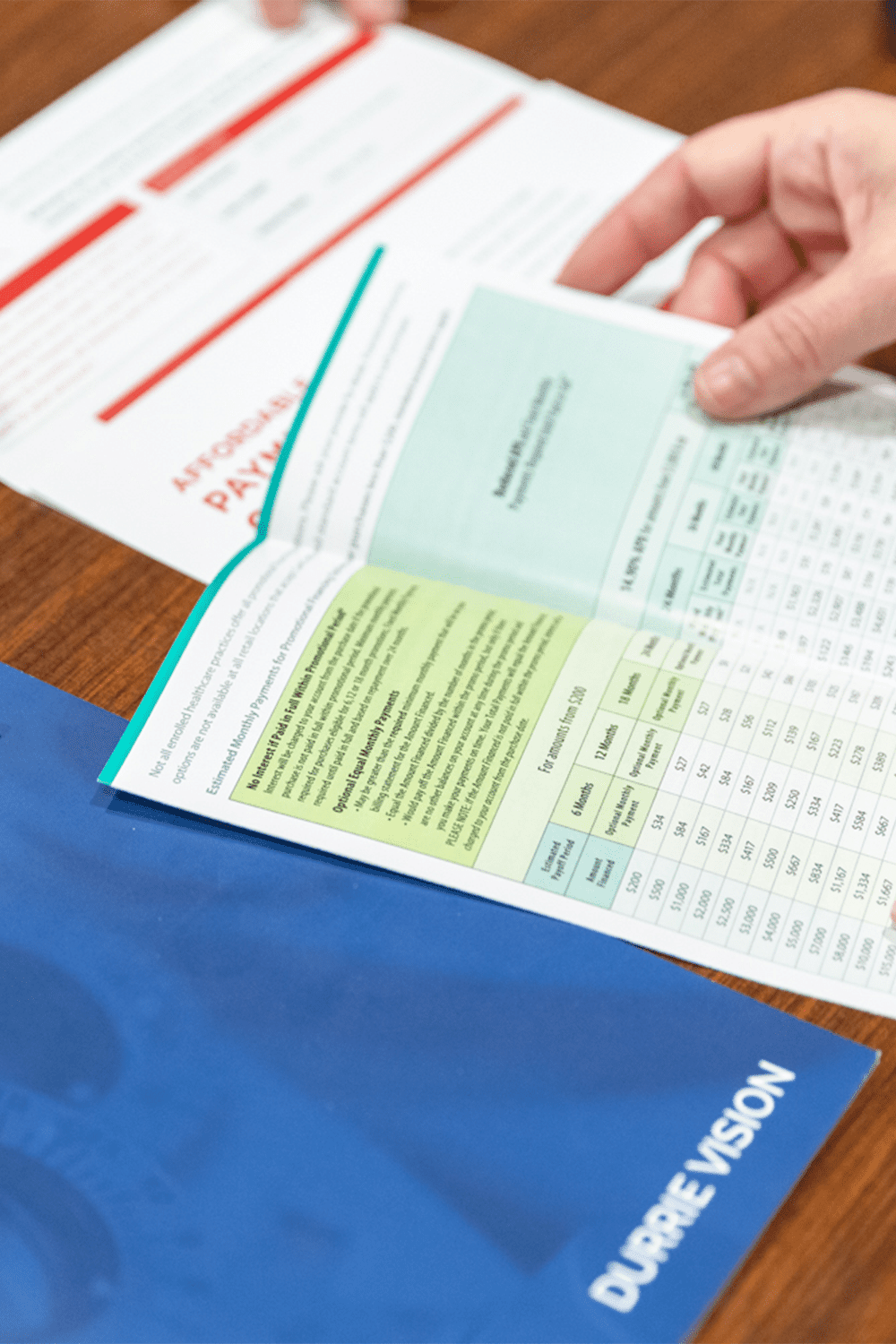

See Clearly Now, Pay Later

We want all our patients to see better, no matter their financial situation. That’s why we offer several financing and payment options. With the help of Durrie Vision, the cost of LASIK eye surgery in Kansas City is even more affordable.

$0

No Down Payment Required

0%

Interest-Deferred Financing

24 Months

Pay Over Time

Glasses and Contacts Will Cost You

Use our customizable calculator to reveal the long-term cost of glasses and contacts. Over a lifetime, glasses and contacts are expensive, especially when compared with a LASIK procedure from the experts at Durrie Vision.

Apply These Savings and Discounts to the Cost of LASIK Eye Surgery

Durrie Vision offers a number of savings programs to help make the cost of vision correction more accessible. These include:

- Family Plan – exclusive savings for our patients’ immediate family members

- First Responders – 20% discount for active police, fire, and EMT professionals

- Military – 20% discount for active military

- Research – Various savings available for in-house and clinical study participants

Use FSA or HSA Benefits

Laser vision correction procedures are approved expenses under most Flexible Spending and Health Savings Accounts. Set aside tax-free money for your vision correction procedure. If you continue to wonder how to manage the cost of LASIK, your FSA or HSA account may be your solution.

FSA Facts

- The 2024 contribution limit is $3,200.

- An FSA must be sponsored by your employer; self-employed individuals are not eligible.

- An employee’s yearly FSA allocation is available on the first day of the plan year, regardless of contributions made to date.

- Any money left in an FSA will be forfeited at the end of that year’s plan, though some plans do provide a short grace period that may allow you to carry over some funds into the next year. Check with your employer to see if your plan allows for a grace period.

HSA Facts

- The 2024 contribution limit: $4,150 for individuals or $8,300 for families.

- Funds allocated to an HSA become available as they are deposited into the account.

- Unused funds roll over year to year, continuing to earn interest.

Don’t just take our word for it!

Schedule a Free Consultation

During your free consultation visit, you will meet with an experienced refractive surgeon who will discuss your results along with a custom recommendation for treatment.

Take the LASIK Eligibility Assessment

Are you a candidate for laser vision correction? Let's find out. Take our 60-second online test to see what procedure might be the best option for your vision and lifestyle.